Nevertheless, over the long-term, getting a residence can be a good way to boost your net worth. And also when you buy, you can secure a set rates of interest, which suggests your regular monthly settlements are much less most likely to boost contrasted to leasing. Owning a residence also has actually the added advantage of providing a stronger sense of security for you as well as your household. And when you have, you have the flexibility to personalize your space nevertheless you like. Mortgages come with all type of different rates of interest as well as terms. These influence how much time it will take to settle your funding as well as just how much your regular monthly repayments will certainly be.

Preapproval times are between hours as well as shutting times ordinary around 1 month. Preapproval times are not as quick as other lenders, with a one- to two-day turn-around on preapproval letters. If you're a VA debtor, Guaranteed Price waives all finance costs. Certified consumers will get a lightning-fast preapproval letter-- within three mins-- which is a benefit in an open market. Borrowers likewise can lock their rate within 10 minutes of being preapproved. Preapproval can take as little as 30 minutes, or as much as eventually.

- Some loan providers focus on a rapid preapproval procedure, while others might use discount rates for the military or existing customers.

- The lender scores a few of the very best customer complete satisfaction scores amongst leading picks.

- Some lending institutions will certainly offer a finance with a rating to 550 http://jeffreyiupc551.jigsy.com/entries/general/bad-credit-rating-mortgage-lending-institutions or 500 in many cases, however you possibly won't get the exact same high quality experience as with New American Funding.

- Default insured mortgages can have a maximum amortization duration of 25 years.

- As an internal lender with lending kinds that extend the realty spectrum, personalized term capabilities, and also a best-rate assurance, Nationwide Residence Loans can not be beaten for all-in-one solution.

- Ratehub.ca makes it easy to pick better, by showing you the best home loan prices in British Columbia, all in one place.

LoanDepot supplies the distinctive advantage of forgoing refinance charges and compensating appraisal costs for all future refinances after your initial re-finance with loanDepot. Home mortgages are secured loans that make use of the worth of the residence you're getting as collateral. The disadvantage of a home mortgage is if you're incapable to make your regular monthly settlements, the loan provider can take the property. LendingTree allows you contrast home mortgage items from over 1,500 loan providers. Take a look at Insider's everyday home mortgage rate updates to see the ordinary home loan prices for different term lengths.

Looking at the car loans as well as programs that financial institutions, credit unions, as well as brokers supply will aid you recognize every one of your options. Their VA financings carry rate of interest as reduced as 2.250%, APRs as low as 2.718%, with 10- to 30-year terms. These prices call for a 1% loan origination cost, but that can be waived for a 0.25% rise in interest rate if you choose. A $250,000 VA financing refinanced to 15 years at 2.250% interest and also 2.718% APR will certainly have a month-to-month principal and rate of interest repayment of $1,637.

Canada Rate Of Interest From 1951 To 2022

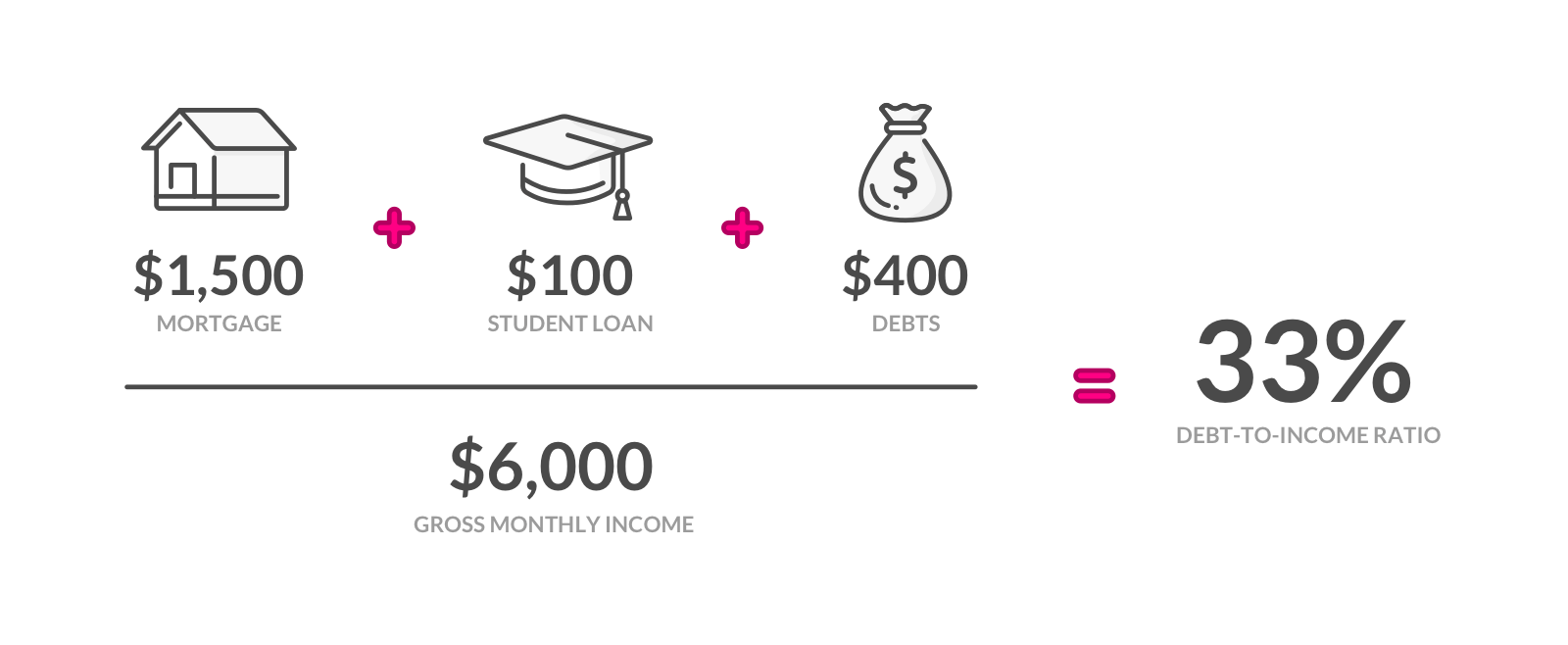

Rather, you have to connect to a representative in order to access this information. However, lending institutions sometimes also market their loans' servicing civil liberties. A lot of lending institutions will certainly require you to have a good credit rating as well as affordable debt-to-income ratio prior to they'll consider you for a home loan. For adjusting home mortgages, this generally means having a credit rating of 620 and a DTI listed below 50%. You'll additionally need a deposit of at the very least 3%, though you may be needed to have more.

Debtors must have a minimal credit rating of 620 or greater for conventional and also VA fundings. Ally offers set- and adjustable-rate standard as well as big home mortgages and also HomeReady Loans. Flagstar Financial institution has home mortgage products with minimum credit rating needs of 620. The DreaMaker mortgage, a low down payment choice with adaptable credit rating and also revenue needs, is tailored towards customers on a budget plan who could have reduced credit scores. Qualified DreaMaker debtors may also obtain $500 after finishing a homebuying education and learning training course.

Whats More Important: Reduced Mortgage Rates Or Low Closing Costs?

Calculator outcomes are for educational and also informative objectives only as well as are not assured. You must speak with a qualified financial professional before making any kind of personal economic decisions. Guild likewise supplies an FHA No Down program for low to moderate-income homebuyers with below-average credit history and that do not have actually adequate conserved up for a down payment.

Our marketers do not compensate us for favorable reviews or referrals. Our website has detailed cost-free listings as well as information for a variety of financial services from home loans to banking to insurance policy, but we do not include every product in the industry. Additionally, though we aim to make our listings as current as possible, get in touch with the specific suppliers for the current details. Based on this methodology, the most effective home loan loan providers normally have a Bankrate Score of 4.9 celebrities or greater.

What To Search For In A Home Loan Loan Provider

Right here's a picture of the lowest mortgage rates in Canada over the past couple of years, to give you a concept of exactly how today's prices compare traditionally. Shut home loans are the most preferred choice in British Columbia. This is because they generally have lower rates, and most individuals do not expect to boost their mortgage payments. Prepayment choices with closed mortgages, the amount you can boost your regular monthly settlement, and also the dimension of a round figure settlement you can make to your principal, are restricted.

If you do not have much for a down payment now, it could be worth conserving for a few more months. In 2020, the Division of Justice charged Bank of America for unfairly rejecting home loans to grownups with handicaps, despite the fact that they got loans. Financial institution of America paid about $300,000 total amount to individuals that were refused finances. In 2019, the Department of Labor called for Bank of America topay $4.2 million to people who claimed the bank victimized ladies, Black, and Hispanic candidates in the hiring procedure. A Navy Federal employee has actually asserted the lending institution forced home mortgage underwriters to authorize loans also if they really did not have sufficient reason to believe candidates could repay the car loans.